estate tax return due date canada

In that case the due date for filing the 2021 T1 return of a surviving spouse or common-law partner who was living with the deceased is the same as the due date for the deceaseds 2021 return. The due date of this return depends on the date the person died.

Canadian Tax Return Deadlines Stern Cohen

Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date including extensions of Form 706 or the date of filing Form 706 if the return is filed late.

. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related instructions for due date information. Two digits for the month of death. If you fail to file the T3 return by the due date you will be subject to a penalty.

The return must be filed within 90 days of the year end. January 1 to October 31 of the year. Deadline to contribute to an RRSP a PRPP or an SPP.

The final return is sent to the Taxation Centre. If death occurs between November 1 and December 31 the final return is due six months after the date of death Canada Revenue Agency 2018. The estate T3 tax return reports income earned after death.

You should also pay any balance owing no later than 90 days after that year-end. Apr 30 2022 May 2 2022 since April 30 is a Saturday. Final return due date if the death occurred between jan 1 st to oct 31 st the due date is april 30 th of the following year.

In Canada the CRA does not tax the assets of an estate but they do require that all of the tax owing on income up to the date. That would make March 31 2011 her T3 filing deadline. If a taxpayer dies between January 1 and April 30 a return for the year prior to death must be filed within six months of the date of death.

On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death. 15 for each 1000 or part thereof of the value of the estate exceeding 50000. The due date for the final T1 return and the tax payments depends on the date of death.

The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return. Deadline to file your taxes. The T3 tax year starts the day after the death date and the end date can be any.

IRS Form 1041 US. Final return For a graduated rate estate you have to file the final T3 return and pay any balance owing no later than 90 days after the trusts wind-up discontinuation date. ESTATE T3 RETURN.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will probably say that the Form 1041 is due on April 15. The estate is liable for paying the estate tax. For a T3 return your filing due date depends on the trusts tax year-end.

If death occurs between January 1 and October 31 the final return is due by April 30 of the following year. Before filing Form 1041 you will need to obtain a tax ID number for the estate. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension Form 4768 07067 706-A or 706-QDT.

The decedent and their estate are separate taxable entities. The T3 Trust return is due 90 days from the end of the trusts tax year. Last two digits of the year of the applicable filing year.

What Is The Due Date For 2020 Form 1041. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later than 90 days after the trusts tax year-end. That is because the attorney or accountant that applied for the ID number may not understand when the tax.

An estates tax ID number is called an employer identification. Ad Ask Verified Tax Pros Anything Anytime 247365. The T3 needs to be filed 90 days after the trusts year-end.

The T3 Trust Return. 13 rows Only about one in twelve estate income tax returns are due on April 15. For a T3 return your filing due date depends on the trusts tax year-end.

For more information go to Guide T4013 T3 Trust Guide. The due date of this return depends on the date the person died. The gift tax return is due on April 15th following the year in which the gift is made.

Enter the wind-up date on. Filing dates for 2021 taxes. Deadline to file your taxes if you.

Payment due with return. 31 2010 as the estate year-end. The final return can be E-filed.

Report income earned after the date of death on a T3 Trust Income Tax and Information ReturnTo find out what income to report on the T3 return see Chart 2For more information see the T4013 T3 - Trust Guide. To get a clearance certificate as quickly as possible executrix Rita may be tempted to choose Dec. However any balance owing on the surviving spouses or common-law partners 2021 return must still be paid on or before April 30 2022 to avoid.

13 rows Only about one in twelve estate income tax returns are due on April 15. 31 rows A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Note that the T3 filing deadline is 90 days after the year-end chosen by Rita.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. The Estate return if required can have a year end up to one year after death. Any taxes owing from this tax return are taken from the estate before it can be settled dispersed.

To get a clearance certificate.

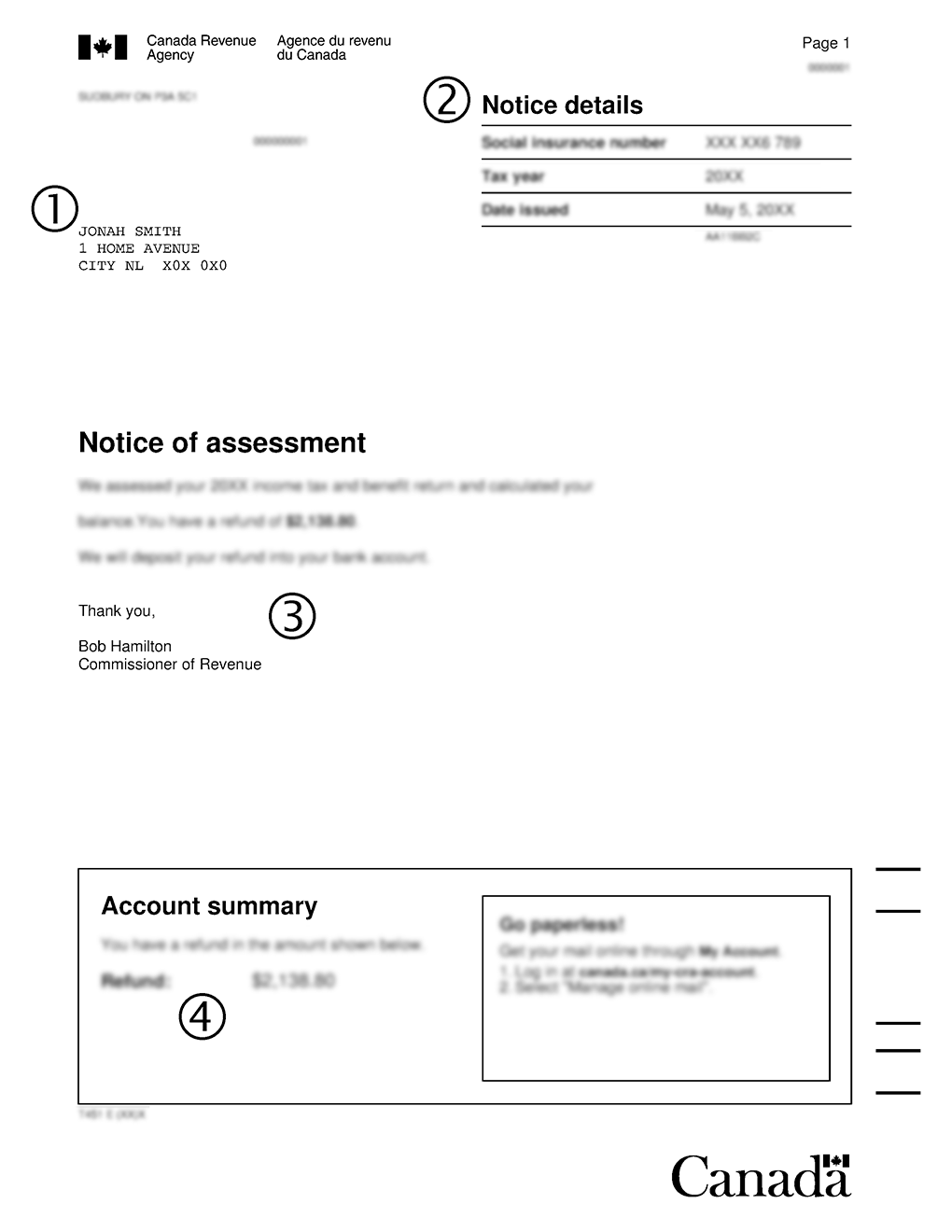

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

The Cra Just Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes

Cra T1135 Forms Toronto Tax Lawyer

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

How To Complete A Canadian Gst Return With Pictures Wikihow

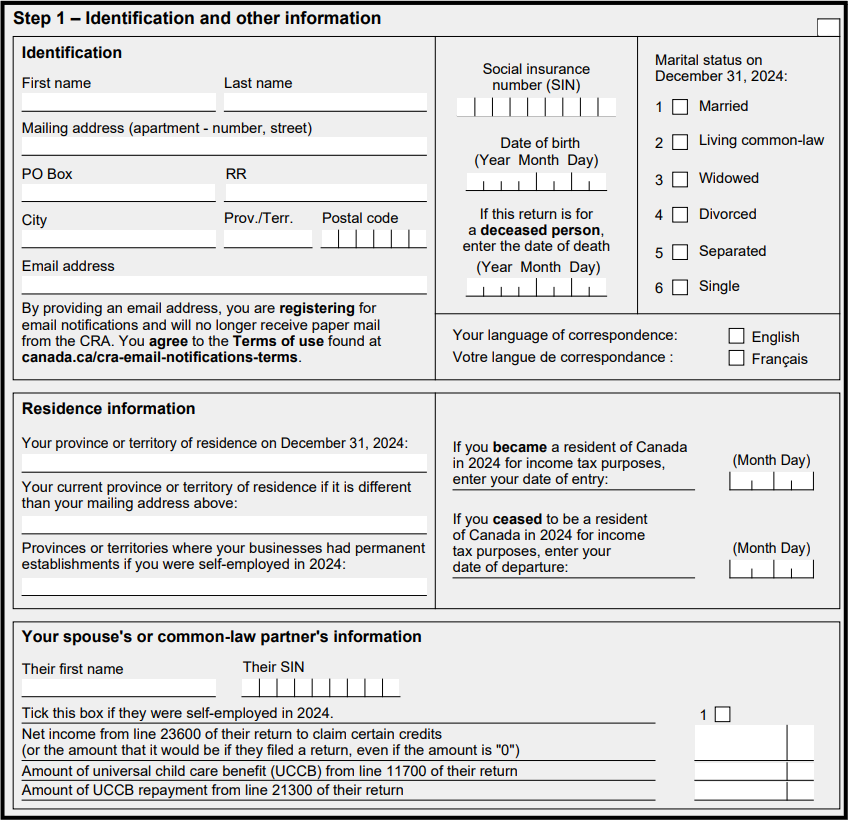

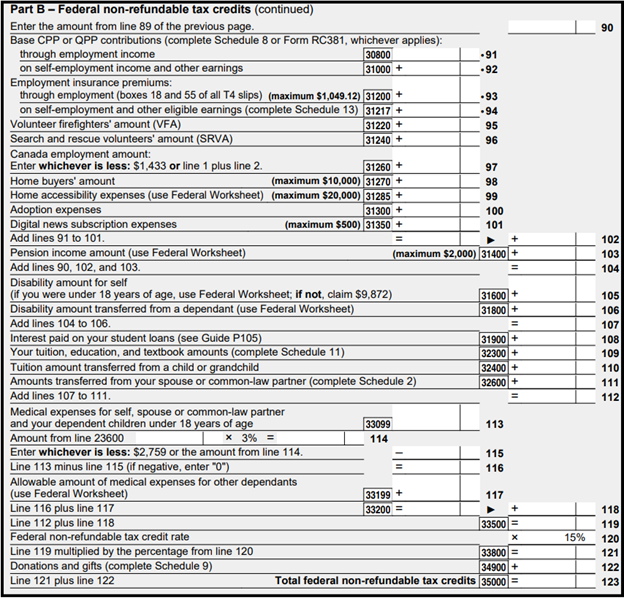

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Self Employed T1 General Sample

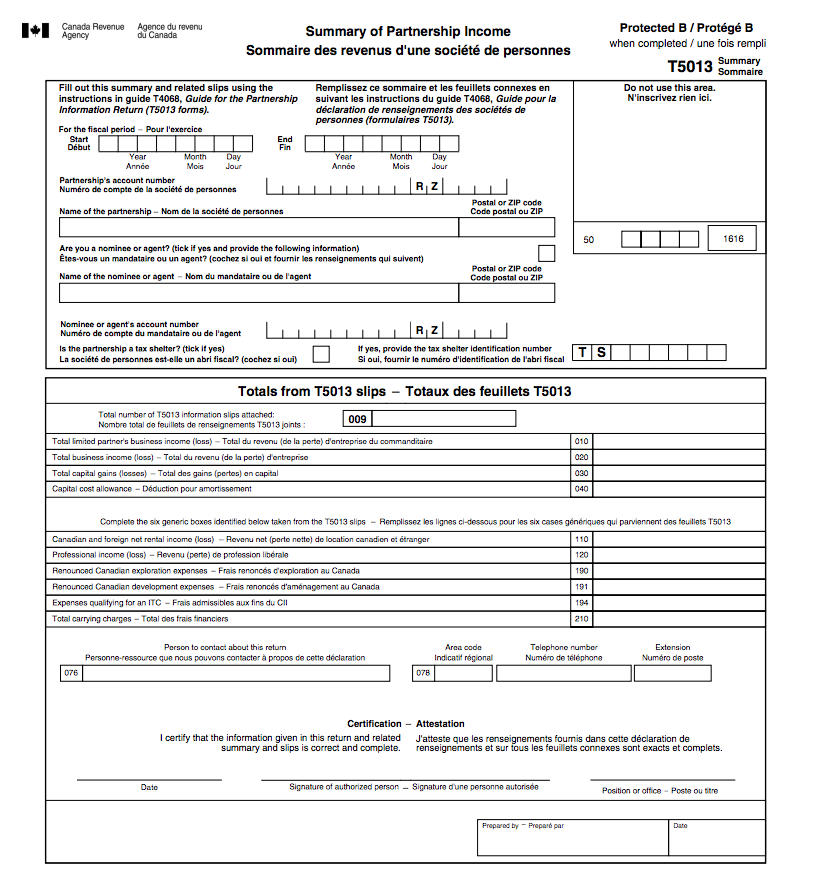

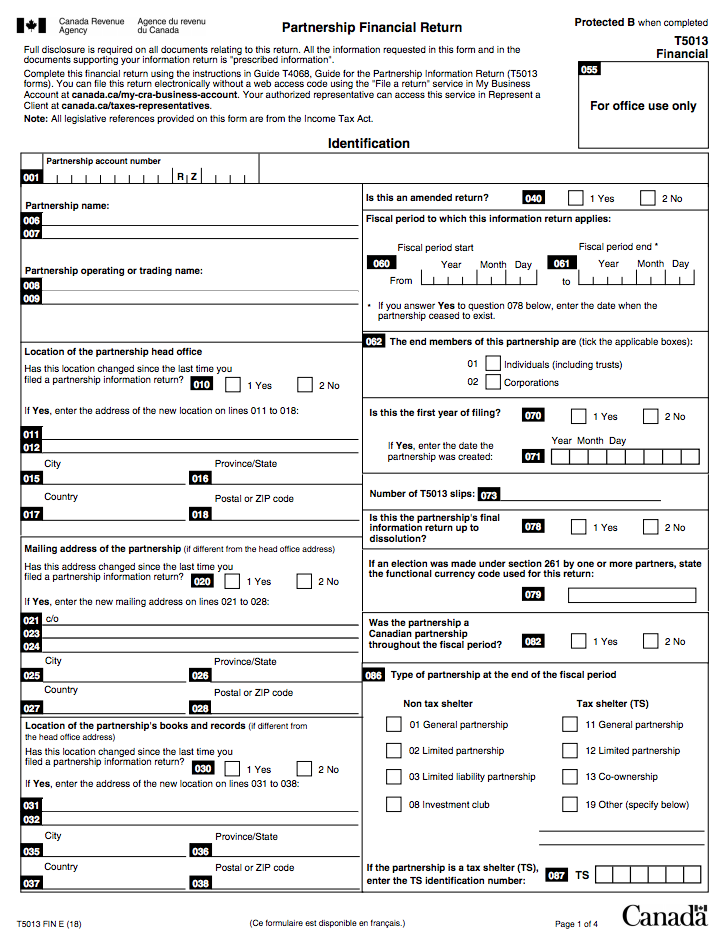

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

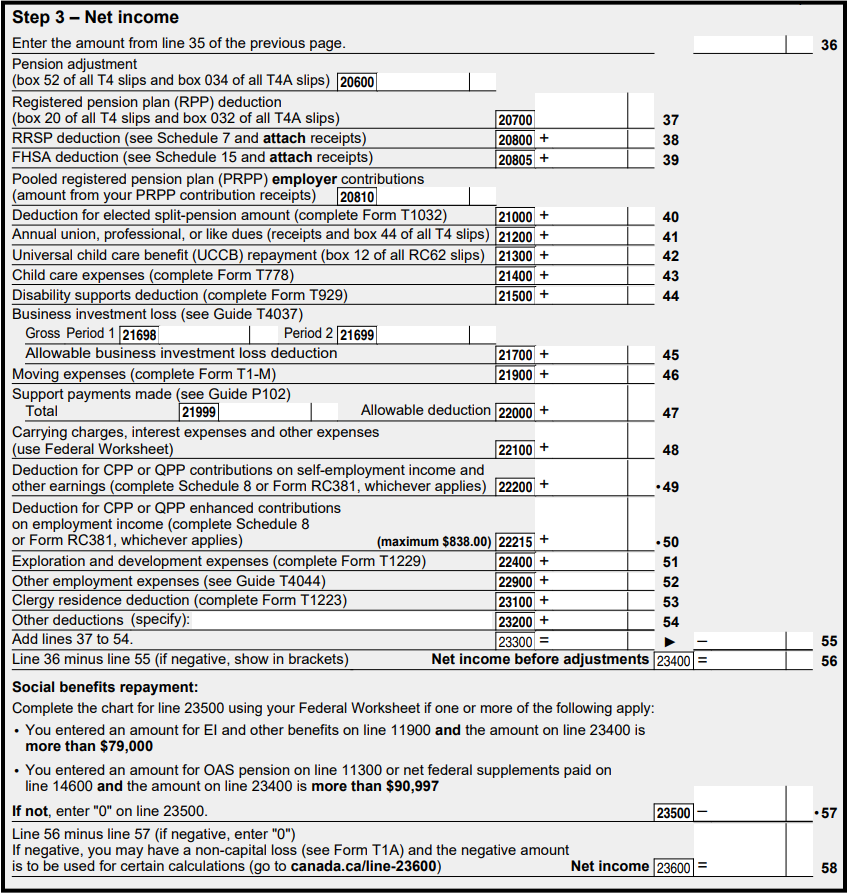

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

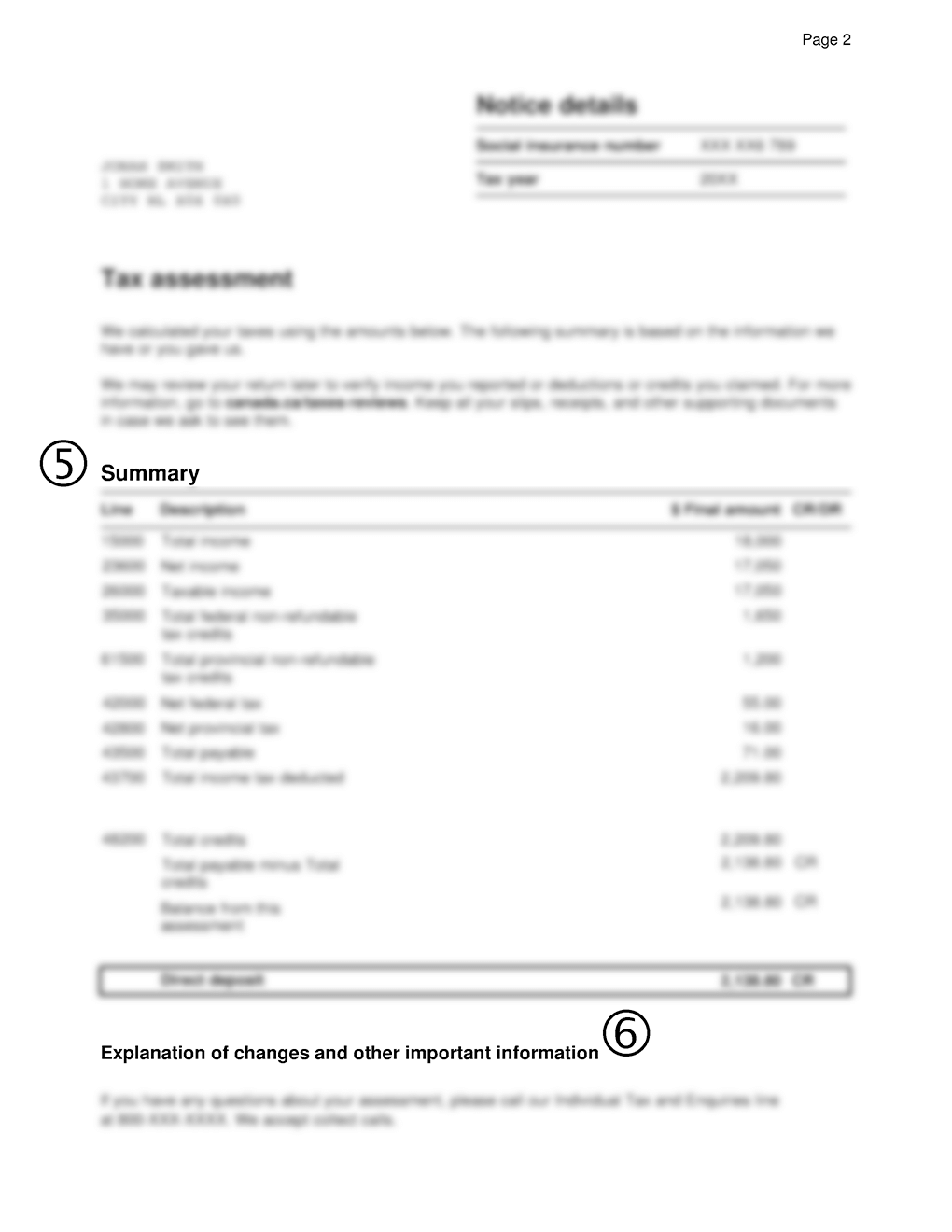

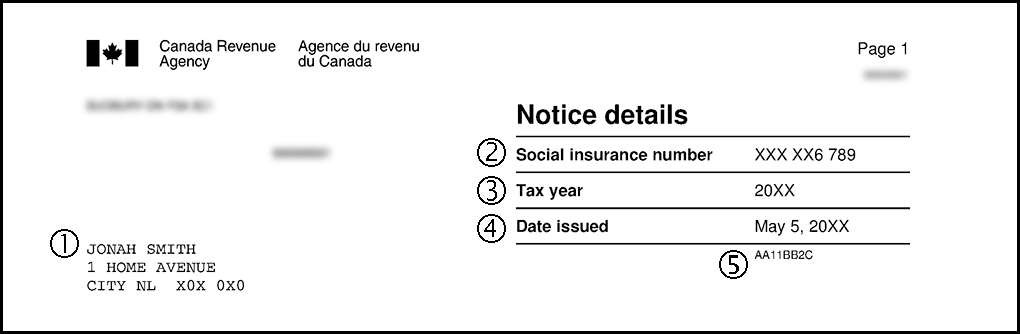

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca